REPORT MANUAL

CHAPTER 2 - EMPLOYEE MANAGEMENT

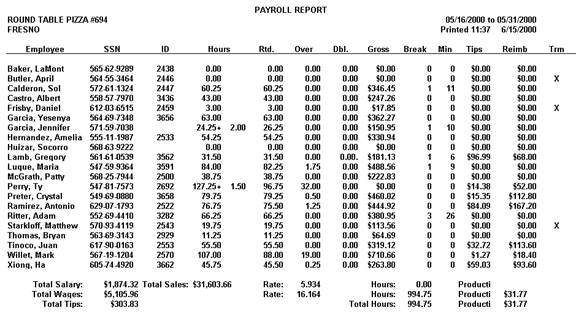

The Payroll Report prints only at the end of the pay period defined in employee management under payroll setup (reference your system manual). Modification at the payroll setup can only be done at the end of the pay period. The Payroll Report gives you all the information needed to complete the payroll.

Note: Next to the hours, a “+” or “-“ sign will indicate a change made in the Time Card Exceptions.

-

Payroll

Period (Weekly, biweekly, 2x per month, or monthly).

-

Employee

(Name of the employee).

-

SSN (Employee’s social security

number).

-

Hours

(Total number of hours worked by the employee in the payroll period).

-

Standard

Time (Hours worked by the employee considered as standard time).

-

Over

Time (Hours worked by the employee considered as over time).

-

Double

Time (Hours worked by the employee considered as double time).

-

Gross

Pay (Total hours worked by the employee multiplied by the hourly wage;

this amount includes standard, over time, double time if incurred, but

excludes all the taxes).

-

Break

(Number of paid breaks taken by the employee in the payroll period).

-

Total

Minutes (Minutes spent on paid breaks by the employee in the payroll

period).

-

Tips

(Total amount of tips received by the employee over the payroll

period).

-

Reimbursement

($ Amount given to the driver as a reimbursement for the deliveries;

this reimbursement is calculated automatically and given to the driver at

the end of the pay period).

-

Termination

(If an employee was terminated during the pay period, an “X” will be

shown in this column).

-

Total

Salary (Total gross amount spent for employees with “S” Salary and “T”

Track in their payroll file).

-

Total

Wages (Total gross amount spent on “H” Hourly wage employees).

-

Total

Tips (Total amount of tips received by the employees within the payroll

period).

-

Total

Sales (Total net sales of the store within the payroll period).